Alternative Methods of Financing Construction Projects: Mikhail Chuchalin on Crowdfunding and New Approaches

In the construction industry, traditional financing methods, including bank loans and investments by large companies, remain the main sources of capital for project realisation. However, in recent years, alternative approaches have emerged that offer new opportunities to raise funds.

The realities of recent years are such that alternative financing methods – crowdfunding, private equity and corporate bonds – are becoming increasingly relevant in the construction industry. This trend is driven by several key reasons.

1) Limited access to traditional financing

Bank lending, while the primary source of financing, is often accompanied by high collateral and financial reporting requirements. For many construction companies, especially SMEs, this becomes a serious barrier.

2) Increased regulation of the financial sector

Financial institutions are tightening their requirements due to increased regulatory pressure and higher risks in the economy – this leads to higher cost of credit and lower availability of loans for new projects. The situation becomes more complicated when it comes to financing innovative or non-standard projects that may be perceived as too risky.

3) Volatility in financial markets

The economic instability and global crises of recent years have significantly increased volatility in financial markets. This situation complicates long-term planning and makes traditional sources of financing less reliable. Construction projects, which often require multi-year investments, are particularly affected by this uncertainty.

Thus, with limited access to traditional financing and increasing risks in the financial markets, the need for alternative financing methods is becoming increasingly apparent. New approaches offer construction companies new opportunities to raise capital and minimise financial risks, thus ensuring sustainability and flexibility in project delivery.

Crowdfunding and other alternatives to traditional financing

The most popular alternative financing option has become crowdfunding, which allows raising funds from a large number of people through specialised online platforms (Kickstarter, Indiegogo and others). Projects are placed online, and users can invest money in their favourite ideas, receiving various rewards in exchange: from early access to the product to a share in the project. The essence of crowdfunding is that many small contributions from a wide audience help to raise a significant amount of money for the implementation of the project. Unlike traditional schemes, where funds are provided by banks or venture capital funds, crowdfunding allows you to directly raise money from the target audience.

This approach is especially valuable for start-ups and innovative projects, which may find it difficult to obtain standard funding. Crowdfunding also acts as a marketing platform, allowing project creators not only to raise funds, but also to test interest in the product at an early stage. As a result, companies get feedback from potential audiences and create a community of loyal users who support the project from the very beginning.

Despite all the advantages, crowdfunding comes with high risks. With the growing popularity of this method on platforms, competition for investors’ attention is increasing, which requires a well thought-out strategy and a unique offer. Also, the possibility of underfunding can never be ruled out – if a project fails to reach its fundraising goal, the money is returned to the investors and the construction remains unfunded. Crowdfunding also requires public disclosure of the details of the idea, which sometimes leads to its copying by competitors even before the campaign is finalised.

Nevertheless, the popularity of this method continues to grow. The global crowdfunding market size in 2023 is estimated at $1.4bn and is forecast to grow from $1.6bn in 2024 to $4.5bn by 2032, showing a compound annual growth rate (CAGR) of 13.8% during the forecast period. Meanwhile, North America is the absolute leader of this segment with a share of 40.4% in 2023.

This approach was initially popular in the field of technology and startups, but gradually it found its application in the construction industry as well.

In addition to crowdfunding, there are other alternative methods of financing that are actively developing thanks to modern technologies. One such approach is the use of blockchain platforms to finance construction projects. Blockchain enables transparent and secure fundraising mechanisms, providing investors with confidence in the safety of their investments. In addition, smart contracts can automate many processes related to profit distribution and fulfilment of obligations to investors. Another interesting approach is the use of so-called ‘hybrid’ financing, which combines traditional methods with new instruments. For example, companies are able to attract large investments from institutional investors and then use crowdfunding to complete a project or its individual stages. This allows for more efficient risk allocation and increases the chances of successful completion of construction.

Prospects and obstacles of alternative financing

Despite the significant benefits, alternative methods of financing construction projects face challenges. One of the main ones is the need to build trust among investors, especially in a volatile construction market. In addition, it is important to consider the legislative aspects that often limit the use of such approaches in different countries.

Nevertheless, the potential for alternative financing in the construction industry is enormous. Crowdfunding and other innovative methods open up new opportunities for the realisation of projects that were previously inaccessible due to the limited availability of traditional sources of financing. In the future, analysts expect these approaches to continue to grow in popularity, especially with global digitalisation and the drive towards more sustainable development.

In conclusion, alternative financing methods offer new ways to realise construction projects, making them accessible to a wider range of investors and participants. These innovative approaches play a key role in the development of the industry, helping it to adapt to today’s challenges and needs.

Sources:

Crowdfunding Market Size, Share & Industry Analysis, By Type (Equity-based, Debt-based, Blockchain-based, and Others), By End-user (Startups, NGOs, and Individuals), and Regional Forecast, 2024-2032

https://www.fortunebusinessinsights.com/crowdfunding-market-107129

Crowdfunding – statistics & facts

https://www.statista.com/topics/1283/crowdfunding/#topicOverview

Crowdfunding & FinTech Law Blog

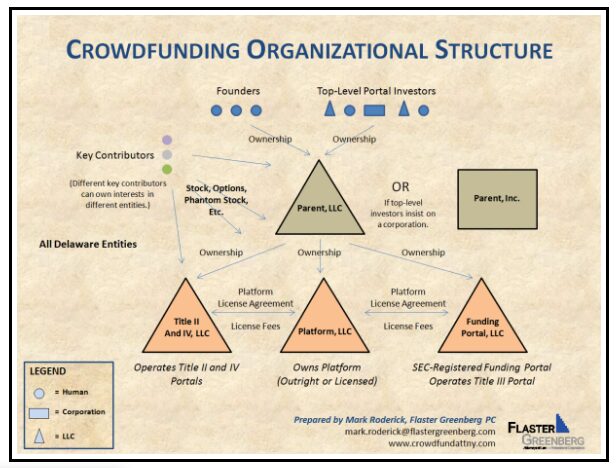

https://crowdfundingattorney.com/tag/crowdfunding-infographic/